The Medicare Advantage Agent Near Me PDFs

Wiki Article

Our Medicare Advantage Agent Near Me Statements

Table of ContentsThe Buzz on Medicare Advantage Agent Near MeSee This Report on Medicare Advantage Agent Near MeHow Medicare Advantage Agent Near Me can Save You Time, Stress, and Money.Some Known Details About Medicare Advantage Agent Near Me More About Medicare Advantage Agent Near Me

Based upon our evaluation, the ordinary premium in 2020 for Medigap was $1,660, indicating an agent would be paid $322 for the first year and also $166 as a revival payment. Due to the fact that costs and rate adjustments for policies can differ, commissions may shift based upon recipient, policy, and also area. Insurers additionally might make extra settlements, in enhancement to registration commissions.These tasks may consist of marketing, innovation, training, as well as conformity; the agencies act as an intermediary between representatives and insurers. Unlike registration compensations, management repayments are not established by any kind of controling or regulatory body; rather, they are established by insurance providers in negotiation with each independent company. For MA and also Part D, CMS's Medicare advertising standards develop that these repayments "must not surpass FMV or a quantity that equals with the amounts paid to a 3rd party for comparable solutions during each of the previous 2 years." These settlements offer an additional channel of financial backing in between insurance firms and firms and also representatives.

The Definitive Guide for Medicare Advantage Agent Near Me

MA and Part D strategies are measured via the star rankings program and are made up in a different way for providing a top quality participant experience. Pay-for-performance might be taken into consideration component of the payment version for agents and also companies. As well as fourth, the renewalcommissions version is a double-edged sword. Making sure commissions also if beneficiaries stay with their initial plans may aid protect against unneeded changing.

Policymakers could take into consideration defining a minimum level of service needed to gain the renewal or switching payment. Representatives are an important resource for recipients, yet we should reimagine settlement to ensure that rewards are a lot more very closely aligned with the goals of giving visit this website guidance as well as guidance to beneficiaries and without the risk of competing monetary interests.

Medicare Advantage Agent Near Me Can Be Fun For Everyone

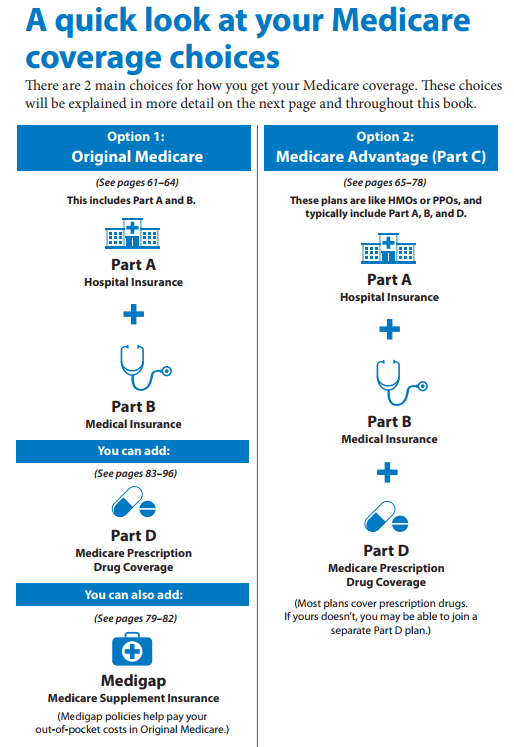

It's typical for people looking for a new medical insurance strategy to undergo an insurance coverage agent, but is this essential when it comes to Medicare? The circumstance will differ depending upon the kind of Medicare you desire (Medicare Advantage Agent near me). If you do select to choose an agent, the information can still make the procedure vary commonly.If you're just intending to enlist in Original Medicare (Medicare Components An and also B), after that you won't require to utilize an insurance coverage agent. As a matter of fact, you won't have the ability to utilize an insurance coverage agent-- this sort of Medicare is only offered from the federal government. Insurance representatives will never ever come into the picture - Medicare Advantage Agent near me.

This is due to the fact that Part D strategies are sold by personal insurance provider. Medicare Advantage is without a doubt the most typical type of Medicare insurance policy that is sold via insurance representatives. Medicare Benefit plans, likewise called Part C plans, are basically a method of obtaining your healthcare insurance coverage with a personal plan.

Excitement About Medicare Advantage Agent Near Me

Some Component C intends included prescription drug strategies packed with them, and also some don't. If yours does not come with a PDP, after that it can be feasible to get Component C from one firm and also Part D from another, while dealing with 2 separate representatives for each and every strategy. Medicare Supplement intends, additionally referred to as Medigap plans, are strategies that cover out-of-pocket expenses under Medicare.These plans are also marketed by exclusive insurance provider, which suggests that insurance policy representatives will certainly have the ability go to this site to market them to you. When it pertains to Medicare insurance coverage representatives, there are normally two types: captive and independent. check Both can be licensed to sell Medicare. Although "restricted" has a very adverse undertone, it is simply utilized to describe representatives who benefit just one business, instead of agents who can function with a selection of insurer.

The standard manner in which you can think about restricted versus independent representatives is that captive representatives are sales representatives that are acquired to sell a specific insurance policy item. Independent representatives, on the other hand, are extra like insurance coverage brokers, indicating that they can offer you any kind of kind of insurance item, and aren't restricted to one company.

Not known Facts About Medicare Advantage Agent Near Me

As you can visualize, there is a much better degree of flexibility that includes working with an independent insurance agent instead than a captive one. Independent agents can consider every one of the insurance policy items they have accessibility to and look for the one that functions best for you, while restricted representatives can just offer you one particular thing, which might not be a great fit.

Independent representatives can just locate one more strategy that fits your needs much better. An individual may have currently done their research and knows which plan they desire and also which price they desire to pay.

Report this wiki page